Life Insurance in and around Albuquerque

Get insured for what matters to you

Life happens. Don't wait.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

If you are young and newly married, it's the perfect time to talk with State Farm Agent Tamara De La O about life insurance. That's because once you buy a home or condo, you'll want to be ready if tragedy strikes.

Get insured for what matters to you

Life happens. Don't wait.

Love Well With Life Insurance

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With coverage options from State Farm, you can lock in fantastic costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Tamara De La O or one of their resourceful representatives. Tamara De La O can help design coverage options personalized for coverage you have in mind.

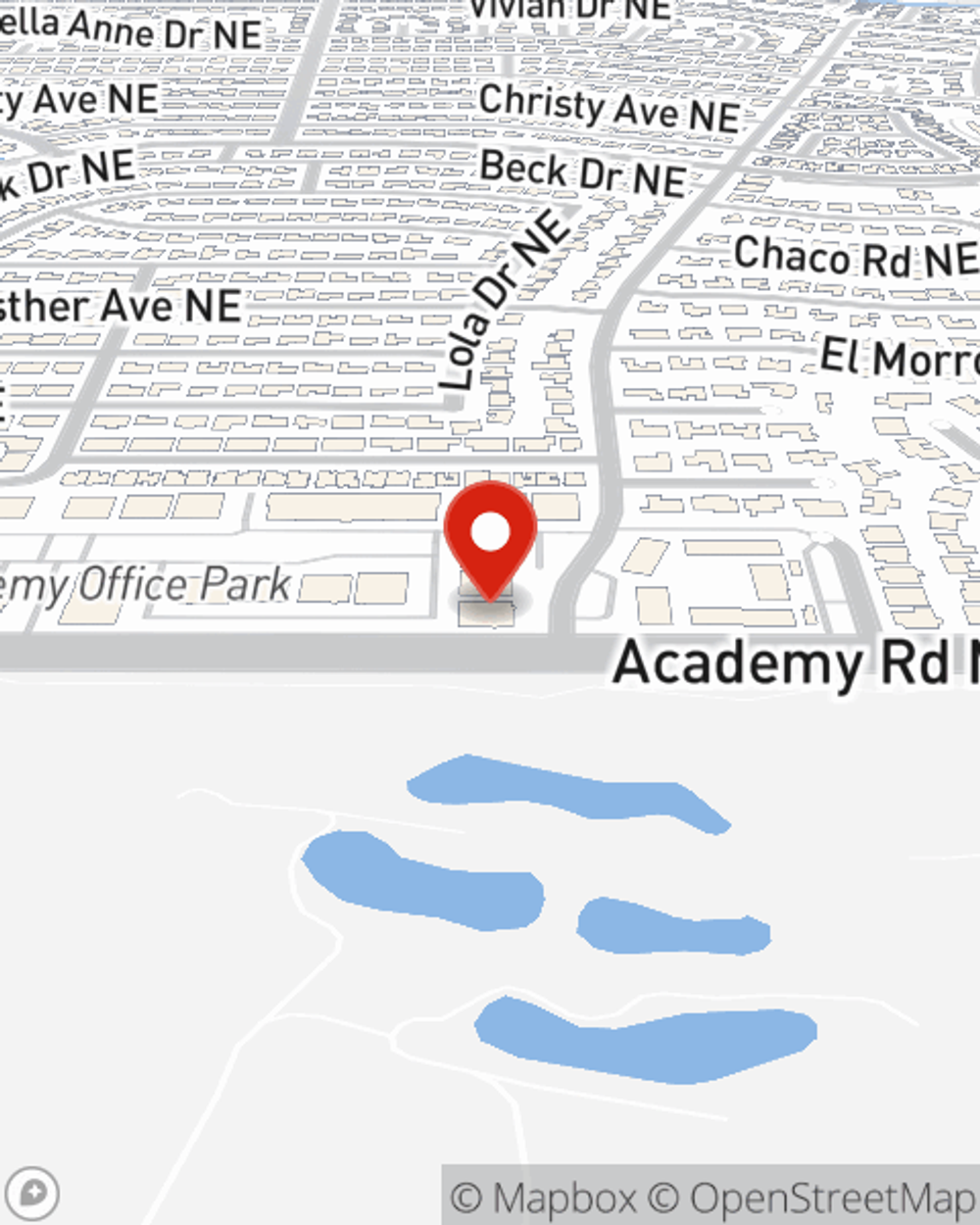

Regardless of where you're at in life, you're still a person who could need life insurance. Visit State Farm agent Tamara De La O's office to discover the options that are right for you and the ones you love most.

Have More Questions About Life Insurance?

Call Tamara at (505) 823-9333 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Tamara De La O

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.